Kenya Airways PLC has selected financial advisers from Seabury Securities to help them rearrange their current debt situation. According to people from the inside, the airline, which is 48.9% subsidized by the Kenyan Government, is facing mounting debts after passenger numbers were depressed because of the pandemic.

A representative for the airline is currently in talks with several consultants such as Seabury, but at current has declined to comment any further. The airline has been banking on the Government to take on and absorb its debt to date, which has totaled 92.5 billion shillings, with approximately $847 USD in 2020. This plan collapsed when the proposal to fully nationalize the carrier collapsed.

The restructuring of the airline's debt would cost an estimated $1 billion, and the Kenyan Government would need to inject funds into the airline for this to work. The East African Nation's Treasury has set aside around $750 million to assist with the debt according to the International Monetary Fund, with the Kenyan Government setting aside 26.6 billion shillings to help Kenyan Airlines along with other state-run companies in a supplementary budget, which is running until June 2022.

The airline, also known as KQ, made losses of 11.5 Billion Shillings for the six months through June 30, 2021. This figure was before tax and was better than the same period in 2020, in which the airline lost 14.4 billion Shillings before tax.

Cash-on-hand was 3.2 Billion Shillings in 2021, up year-on-year from 2020 when the airline had 1.3 billion shillings. Whilst it does expect 65% of pre-pandemic levels this year, it isn't adding new routes to its schedule to prevent any further loss to the company. The airline, in fact, suspended seven routes in 2020 in its fight to keep cash, says CEO Allan Kilavuka. Kenya Airways has been in distress for years, first noticed in 2017 when the Kenyan Government agreed on a "debt-for-equity" agreement with the airline, a move that allowed them to control the airline. Filings also show that an 11.1 billion shilling grant was given in 2020.

Comments (0)

Add Your Comment

SHARE

TAGS

NEWS kenyadebtkenya airwaysrecoveryrestructureRECENTLY PUBLISHED

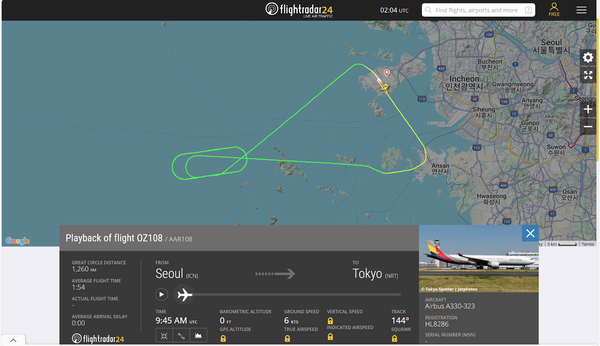

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Seattle Plane Strike 2025: Japan Airlines and Delta Collision Raises Safety Concerns

Seattle-Tacoma International Airport saw a concerning incident on Wednesday morning when a Japan Airlines (JAL) plane clipped a parked Delta Air Lines jet while taxiing. Thankfully, no one was injured, but passengers described the collision as a frightening experience.

NEWS

READ MORE »

Seattle Plane Strike 2025: Japan Airlines and Delta Collision Raises Safety Concerns

Seattle-Tacoma International Airport saw a concerning incident on Wednesday morning when a Japan Airlines (JAL) plane clipped a parked Delta Air Lines jet while taxiing. Thankfully, no one was injured, but passengers described the collision as a frightening experience.

NEWS

READ MORE »